Admin Admin

2 mins read . 4 months agoAbu Dhabi vs. Dubai: Which Is Better for Real Estate Investment?

Introduction

The UAE property market has long attracted global investors, with Dubai and Abu Dhabi leading the way. While Dubai often dominates headlines, Abu Dhabi is emerging as a stable, lucrative real estate market. Understanding the differences between the two cities can help investors make informed decisions about property investments in the UAE.

Market Stability & Growth

Abu Dhabi: Known for its stability, Abu Dhabi offers steady capital appreciation, lower volatility, and long-term growth. Government-backed initiatives and careful urban planning make it a secure choice for conservative investors.

Dubai: Dubai’s market is highly dynamic, with rapid capital appreciation and high transaction volumes. While it offers potentially higher short-term returns, the market can experience fluctuations due to global economic conditions.

Property Prices

Abu Dhabi: Property prices in Abu Dhabi are generally slightly lower than Dubai, especially for luxury villas and apartments. This creates opportunities for long-term value growth with relatively lower upfront investment.

Dubai: Dubai is considered one of the most expensive real estate markets in the Middle East, especially in prime areas like Palm Jumeirah, Downtown Dubai, and Dubai Marina.

Rental Yields

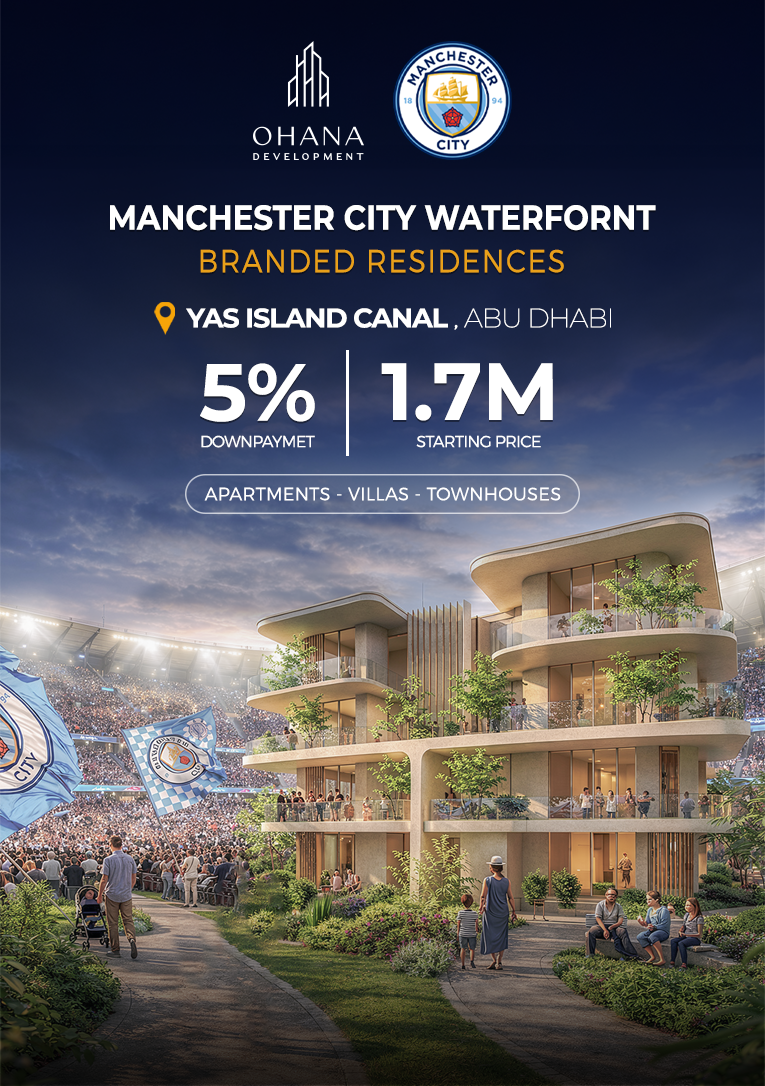

Abu Dhabi: Rental yields typically range from 6%–7%, providing stable returns for landlords. Popular areas include Yas Island, Saadiyat Island, Reem Island, and Al Raha Beach.

Dubai: Dubai offers slightly higher rental yields averaging 6%–8%, driven by strong demand from expatriates and investors, particularly in high-density urban areas.

Lifestyle & Community

Abu Dhabi: Focuses on quality of life, with gated communities, waterfront developments, and eco-friendly projects such as Masdar City and Saadiyat Grove. Ideal for families and long-term residents.

Dubai: Offers a fast-paced lifestyle with luxury amenities, nightlife, and tourism-driven infrastructure, attracting investors and tenants looking for urban vibrancy.

Investment Strategy

Abu Dhabi: Best suited for investors seeking stability, long-term growth, and sustainable communities. Villas and waterfront properties offer solid appreciation potential.

Dubai: Appeals to investors targeting high short-term returns, off-plan projects, and luxury apartments in high-demand urban areas.

Conclusion

Both Abu Dhabi and Dubai offer unique advantages for real estate investors:

Abu Dhabi provides stability, lower entry costs, and long-term growth.

Dubai offers high capital appreciation, dynamic market opportunities, and premium rental yields.

Investors should consider their risk appetite, investment horizon, and lifestyle preferences when choosing between the two markets. A balanced portfolio including properties in both cities can also maximize returns and diversify risk.