Admin Admin

60 mins read . 4 months agoWhy Abu Dhabi is Emerging as a Real Estate Investment Hotspot

Introduction

While Dubai often dominates headlines, Abu Dhabi’s real estate market is quietly transforming into a powerhouse of investment opportunities. With its mix of cultural attractions, luxury developments, and investor-friendly policies, the UAE’s capital is fast becoming one of the most desirable property destinations in the region.

Strong Government Support

One of the main drivers of Abu Dhabi’s growth is its proactive government initiatives. Long-term residency programs such as the Golden Visa and relaxed property ownership laws have boosted investor confidence. Additionally, mega infrastructure projects and sustainable city planning make the capital a safe and forward-looking choice for real estate investment.

Attractive Rental Yields

Abu Dhabi consistently offers competitive rental returns, often averaging between 6%–7%, with certain premium locations going even higher. Demand is strong among expatriates and local families, ensuring steady occupancy rates and long-term rental income for landlords.

Emerging Residential Hotspots

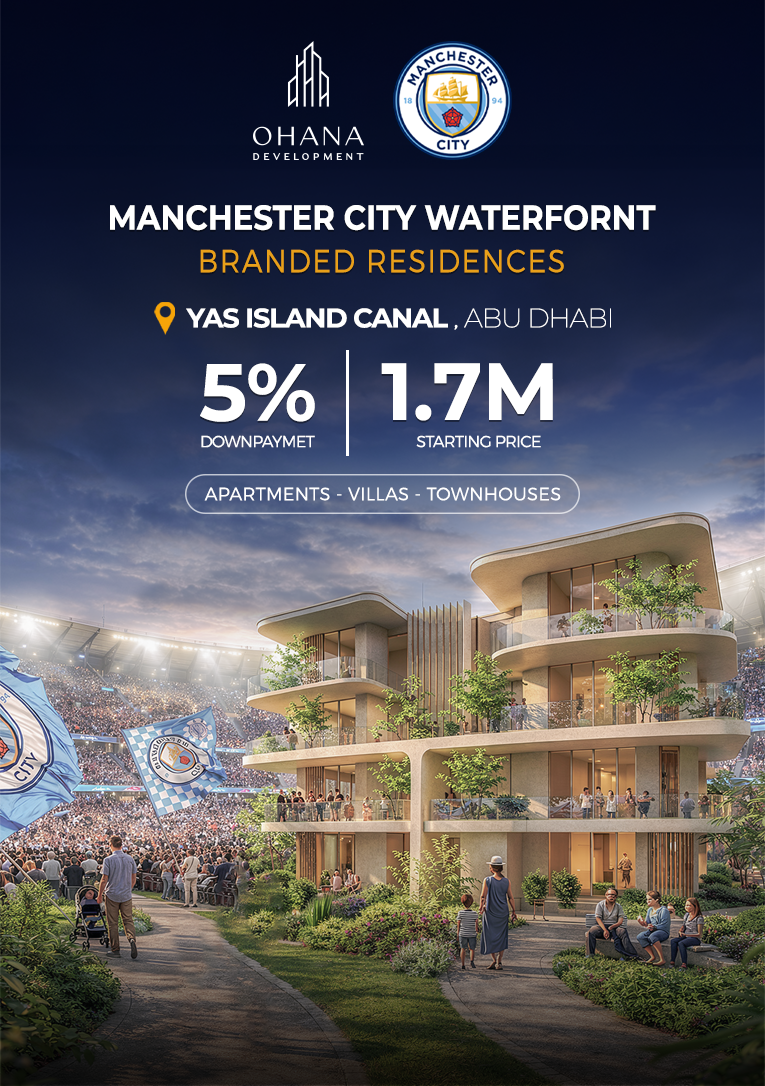

Yas Island: A lifestyle and entertainment hub featuring luxury waterfront apartments and villas near attractions like Ferrari World and Yas Marina Circuit.

Saadiyat Island: Known for its cultural district, pristine beaches, and high-end developments, Saadiyat attracts both investors and lifestyle buyers.

Reem Island: A growing residential community popular with professionals due to its central location, modern apartments, and competitive pricing.

Al Raha Beach: A waterfront neighborhood offering a mix of luxury apartments and villas with excellent connectivity.

Focus on Lifestyle & Sustainability

Abu Dhabi’s real estate strategy emphasizes quality of life and sustainability. Communities such as Saadiyat Grove and Masdar City integrate green spaces, smart technology, and energy-efficient designs, appealing to environmentally conscious buyers.

Competitive Advantage Over Other Markets

Compared to global property hubs, Abu Dhabi stands out for:

Affordable luxury properties relative to London, New York, or Singapore.

High standard of living with world-class healthcare, education, and infrastructure.

Stability and safety, making it attractive for families and long-term residents.

Outlook for 2025 and Beyond

Abu Dhabi is expected to maintain strong momentum in 2025, fueled by mega projects, population growth, and continued government support. With rising demand for both luxury and mid-market properties, the capital is positioning itself as a long-term investment hotspot for global and regional buyers.

Conclusion

For investors seeking strong returns, world-class infrastructure, and long-term stability, Abu Dhabi real estate offers an unparalleled opportunity. Whether it’s a luxury villa on Saadiyat Island or a modern apartment on Reem Island, the capital’s property market is proving to be one of the smartest investments in the UAE.

FAQ's

Why is Abu Dhabi becoming a real estate investment hotspot?

Abu Dhabi offers strong government support, investor-friendly policies, high rental yields, and world-class infrastructure, making it an attractive destination for both local and international property investors.

Can foreigners invest in Abu Dhabi real estate?

Yes. Abu Dhabi allows foreign investors to buy freehold properties in designated areas, including Yas Island, Saadiyat Island, Reem Island, and Al Raha Beach.

What are the best residential areas for investment in Abu Dhabi?

Top hotspots include Yas Island (luxury waterfront villas and apartments), Saadiyat Island (cultural and high-end developments), Reem Island (modern apartments), and Al Raha Beach (waterfront villas and apartments).

What are the typical rental yields in Abu Dhabi?

Rental yields in Abu Dhabi typically range from 6% to 7%, with certain prime locations offering even higher returns for investors.